Buying an apartment: what documents are required, their verification

Acquisition of real estate is a crucial step, because we are talking about significant amounts. So that in the future the transaction is not recognized as invalid or void, it is important to take a responsible approach to its execution. What documents are needed to buy an apartment depends on the specific situation. There are different options: housing in a new or old house, with the involvement of maternity capital, on bail.

You can collect the necessary papers both with the help of realtors and on your own. The registration of the transaction takes place in the bodies of Rosreestr and theoretically can do without intermediaries. But if large sums are at stake or the transparency of the agreement raises questions, be sure to contact realtors for help.

To correctly draw up documents when buying an apartment, make sure:

- Firstly, they must all be original and not show signs of forgery and fixes.

- Secondly, the papers should be submitted to the body authorized to register the transaction.

- Third, it is necessary to follow the procedure established by law.

The content of the article

- 1 Where to begin

- 2 Housing in a finished house (secondary market)

- 3 Housing in a new building (primary market)

- 4 Housing secured by real estate

- 5 Purchasing a room

- 6 Features of buying a home using a certificate

- 7 Where errors can appear

- 8 What documents to check when buying an apartment

- 9 How to draw up a sales contract

- 10 What will happen if you do not follow all the formalities

- 11 What will be on hand after the transaction is completed

- 12 Deal execution cost

Where to begin

The essential conditions of the real estate purchase and sale agreement are information about the alienated object (address, inventory number, area) and its price. The parties must be eligible to complete the transaction. The apartment itself cannot have any encumbrances, that is, be mortgaged, arrested. It needs to be identified, so you can't do without documents of title.

So, as a general rule, the following papers will be required (main package):

- Passports of the participants in the transaction (must be valid at the time of signing the contract).

- Title deed for the apartment.

- Technical passport for the object (produced by the technical inventory bureau at the location of the property).

- Sales contract signed by the parties.

- Acceptance certificate (document for buying an apartment in a new building or on the secondary market).

- Statement on the state. registration of rights to real estate.

- Extract from the personal account (for the secondary market) and the house register.

- Information about the payment of the state duty for the action.

A great option is to submit documents to the MFC when buying an apartment. Experts will help you navigate what specific papers are needed in a given situation, what can be ordered (received) on the spot. You can also start the transaction through the State Services portal, this will save time.

Additionally, you may need the following (additional package):

- Extract from the USRN (can be issued at the MFC or obtained during the procedure).

- Power of attorney giving the right to carry out an action (if the transaction is carried out through a representative).

- Constituent documents of the company (if the party is a legal entity).

- Confirmation of the payment of funds for the object of shared construction.

- The consent of the second spouse to dispose of the property or equivalent (a court decision by which the property was divided, a division agreement, etc.).

- Information on compliance with the procedure for alienating a share in common property (if the property is owned by several persons).

- Current certificate for mat. capital.

The procedure for processing documents when buying an apartment is as follows: the parties sign an agreement, execute it, after which they apply for registration of the transaction. The funds for the object must be transferred before the transfer of ownership. An excellent option is to sign an agreement with a notary, exchange keys and money, and then contact Rosreestr.

Housing in a finished house (secondary market)

You will need the same documents for the purchase of a secondary housing apartment as in a new building. The buyer should definitely familiarize himself with the statement of the personal account. It lists both registered tenants and debts to pay for services. The certificate is valid for 30 days.

An extract from the house book (on the composition of the family) will allow you to find out about those registered in the room, who has the right to use it. Buying real estate in some cases gives the owner the opportunity to evict the residents, but this is unnecessary trouble. You can ask the seller to stop registering other persons.

Documents for buying an apartment in the secondary market include an act of acceptance and transfer. This is especially important if the property is sold with furniture and additional equipment. Reflect the current state of the counters in order to remove responsibility for the debts of the previous user. The act is primarily necessary for the seller, but it can serve as a basis for filing claims if hidden defects are found.

Housing in a new building (primary market)

Documents when buying an apartment from a developer include an act of acceptance and transfer of an object, a certificate of repayment of a debt to the company. It is important that in addition to the purchase and sale agreement there can be an investment agreement. However, the transaction itself is safer, less securities are needed, since there are no previous owners, the history of ownership of the object.

Object purchase options:

- At your own expense;

- For attracted resources.

In the first and second cases, the accounting department of the company must confirm that the money has been credited to the account. It doesn't matter if they came from a buyer or from a bank - it doesn't matter for registration. If the acquirer of the property participated in shared construction, he needs the same certificate from the cooperative.

Important! In case of shared construction, money cannot be transferred in cash. They are received only at the expense of the developer or cooperative. The requirement to transfer funds in cash should be alarming: this is one of the signs of an impending bankruptcy.

Before going to Rosreestr, you need to ensure:

- acceptance certificate of the object (the buyer certifies that he agrees with the quality and volume of work performed);

- technical passport for the apartment (measurements of all rooms, drawing up a plan will be required).

The signing of the acceptance certificate does not deprive the buyer of the opportunity to demand the elimination of certain deficiencies. But, as practice shows, after its registration, the company sharply decreases the desire to eliminate the shortcomings. Without such an act, the transaction cannot be registered with the Rosreestr authorities. If the developer does not eliminate the shortcomings for a long time, there is an option: to sign an acceptance certificate with reservations, which indicates the time frame for finishing the object.

Housing secured by real estate

Mortgages are the best way to solve the housing problem for most families. The law allows the purchase of housing in the primary and secondary market, leaving the right to approve the transaction for the bank. Do not confuse a mortgage with leasing: in the second case, the property remains with the entity financing the transaction. The participation of the bank (debt to it) is necessarily reflected in the registration documents.

A transaction involving funds from a bank is somewhat more complicated:

- an agreement is concluded with the developer for the purchase of real estate;

- an application is submitted to the bank with a request for a loan;

- after receiving the funds, the developer issues a certificate stating that the buyer (shareholder) has no debt for the object;

- option - the seller of an apartment in the secondary market certifies the fact of receipt of money.

Further - the same procedure: you need to collect documents for the object and apply for registration of the transaction. A new apartment also needs a technical passport, and an act of acceptance of the premises into operation is attached to the contract. As a rule, developers have a sales department that helps to collect the necessary papers.

Attention! After registering the transaction, you need to notify the bank within the period specified in the agreement. Failure to comply with this requirement entails sanctions for the borrower. Until the bank provides Rosreestr with a certificate of debt repayment, no action can be taken with real estate.

If housing is purchased on the secondary market, additional documents will be required to purchase an apartment on a mortgage. These include a document on real estate appraisal, and it is necessary at the stage of obtaining a loan from a bank. This is done in order to avoid fictitious transactions when the property is sold at an overpriced price.

It should be noted that the bank will not accompany the client's transaction, limiting itself only to financial participation in the process. But the control will be complete and comprehensive, and in case of violation of the terms of the contract, the institution may demand the return of the entire amount.

Purchasing a room

Documents for the purchase of a share in an apartment include a written notice to other owners of the proposed transaction. They have the pre-emptive right to purchase a room at the price that is offered to others. Without a notice prepared by a notary, the contract cannot be registered with Rosreestr.

According to the same rules, the transfer of ownership of a part of a residential building is formalized, if the shares are not allocated in kind. In theory, the apartment can also be divided into two separate objects, but this is more difficult. However, if the right of pre-emptive purchase has not been respected, other equity holders may only demand that the buyer's obligations be transferred to themselves, but not that the transaction be canceled.

Features of buying a home using a certificate

As you know, for the birth of the first (from 01.01.2020), the second and subsequent children, maternity capital is paid. It can be implemented to improve the living conditions of the family. The main rule is the allocation of shares, where the child will also receive his share. Therefore, the documents for buying a home under maternity capital primarily include a certificate entitling them to financial support.

Other conditions will be required:

- The consent of the guardianship and guardianship authorities (in the case of a parallel sale of the object where the child is registered);

- Reflection in the contract of the fact of the transfer of the share to each child for whom the capital was received, with subsequent registration.

First, you need to contact the Pension Fund (in the territorial office or through the portal of State Services). The issued certificate is suitable for paying for the transaction in whole or in part both in the primary and in the secondary market. The participation of the FIU cannot be avoided, because the money will be transferred to the account of the real estate seller by the specified department.

To complete the transaction, you will need documents confirming the presence of children: birth certificates. The buyer must not be deprived of parental rights over a son or daughter. Supervisory authorities monitor the correctness of the transaction. However, if there are errors, they will not challenge the agreement itself, but only the legality of the transfer of funds according to the certificate.

Important! Matkapital can be used to pay the first installment on a loan or to pay off part of the debt, interest. Detailed instructions on how to manage funds can be found on the FIU website.

Where errors can appear

It is important for the buyer of real estate to make sure that he is purchasing exactly the object that was shown to him. Before checking the documents when buying an apartment, need to match addresses. There were cases when instead of one premises they sold another. Another important aspect is the construction area. Old data sheets may contain errors and inaccuracies.The purchaser has the right to make sure that he is paying for real "meters" and not for air.

Common problems:

- invalidity of the passport (for example, after changing the name);

- technical errors in the data sheet;

- information about the property right (executed with violations);

- problems with the privatization of the object (carried out illegally).

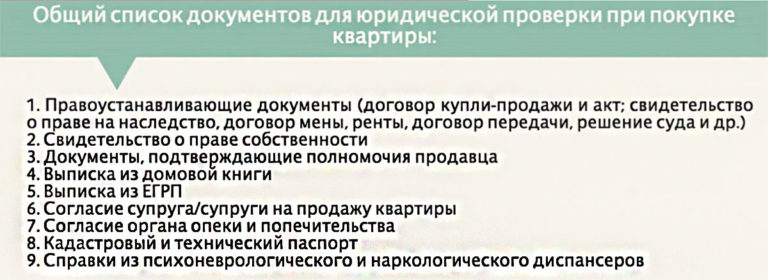

What documents to check when buying an apartment

Papers on the basis of which ownership was transferred to the seller. It should be alarming to carry out several transactions quickly, when each person owned the apartment for a minimum of time. Thanks to an extract from the USRN, you can find out the history of real estate, protecting yourself from a potentially dangerous transaction.

How to draw up a sales contract

You can ask for help from realtors or lawyers: this service is provided separately. The sample agreement forms on the internet are fine too. The simpler the agreement, the better, and a large number of additional conditions should alert.

Important! The price stated in the agreement must be realistic. If the deal is canceled, the parties are returned to their original state. Understating the amount can lead to financial losses.

What will happen if you do not follow all the formalities

Some documents can be requested for insurance, but precaution will not be superfluous, because we are talking about large amounts. For example, if a house is purchased in marriage, consent is required for its alienation from the “second half”. It so happens that a person marries and divorces several times, traces of the ex-wife are lost.

If you do not make sure that other persons do not apply for the apartment, the transaction may be challenged in the future. This is also true for inherited real estate. Any of the successors who, for valid reasons, did not claim their rights, may do so in the future.

Attention! When buying a home on the secondary market, it is worth contacting realtors for a comprehensive check of the transaction. Organizations are financially responsible for the quality of the service provided.

The registration file contains the entire package of documents related to the previous transaction. Professional market participants have the right to get it and research it. Of course, there is no point in doing this for newly created real estate. But if the object has passed through at least one hands, the precaution will not be superfluous.

What will be on hand after the transaction is completed

The result is the state registration of the agreement, on the basis of which the ownership is transferred to the acquirer. Documents received when buying an apartment – this is an extract from the USRN, a technical passport, as well as an agreement signed by the parties. The parties have the right to make copies of the papers used during the procedure for themselves. The seller receives the full amount of money stipulated by the agreement.

The documents issued when buying an apartment in shared construction will contain a certificate that the shareholder has fully fulfilled his obligation to the developer. Be sure to save this paper for future reference (sometimes companies go bankrupt).

Many of the documents received will be needed to issue a property deduction.

Deal execution cost

For citizens it is 2000 rubles, and for those who make a transaction through the portal of State Services it will be 1400. The amount includes only the registration of the contract and making changes to the USRN. An extract costs from 350 rubles. Services of realtors, duplicate documents are paid separately.